Multinationals, including Facebook and Google, could be forced to pay more tax after G7 countries struck a worldfirst deal that will be Under PM Modi's leadership, there is no place for appeasement politics says UP CM Yogi Adityanath#UPElections22 #YogiAdityanath #CNNNews18Subscribe to our channel for the latest news updates Ireland has become the base of European operations for several of the largest international companies, including Google, Apple and Facebook The G7's minimum tax proposal aims to stop companies

How Apple Got Its 2 Tax Rate In Ireland Quartz

Under g7 facebook apple ireland

Under g7 facebook apple ireland-G7 leaders agreed to a 15% global minimum corporate tax rate, which is higher than Ireland's 12 The move will add to pressure on Ireland's 125% rate, which has helped attract a huge number of multinationals, including Apple, Pfizer, Google, and Facebook, to

Global Corporate Tax Crackdown Gets Ethical Investor Boost The Japan Times

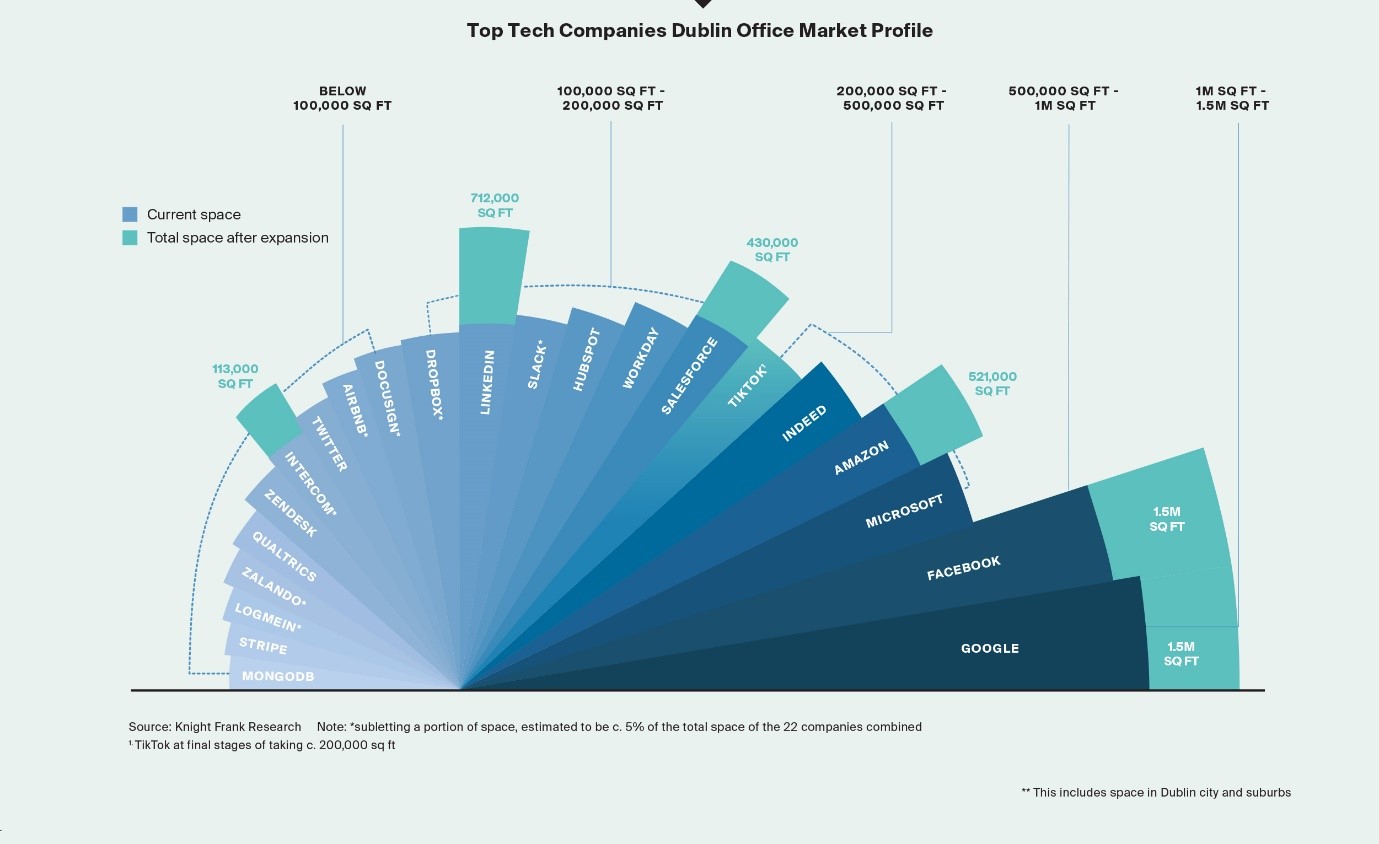

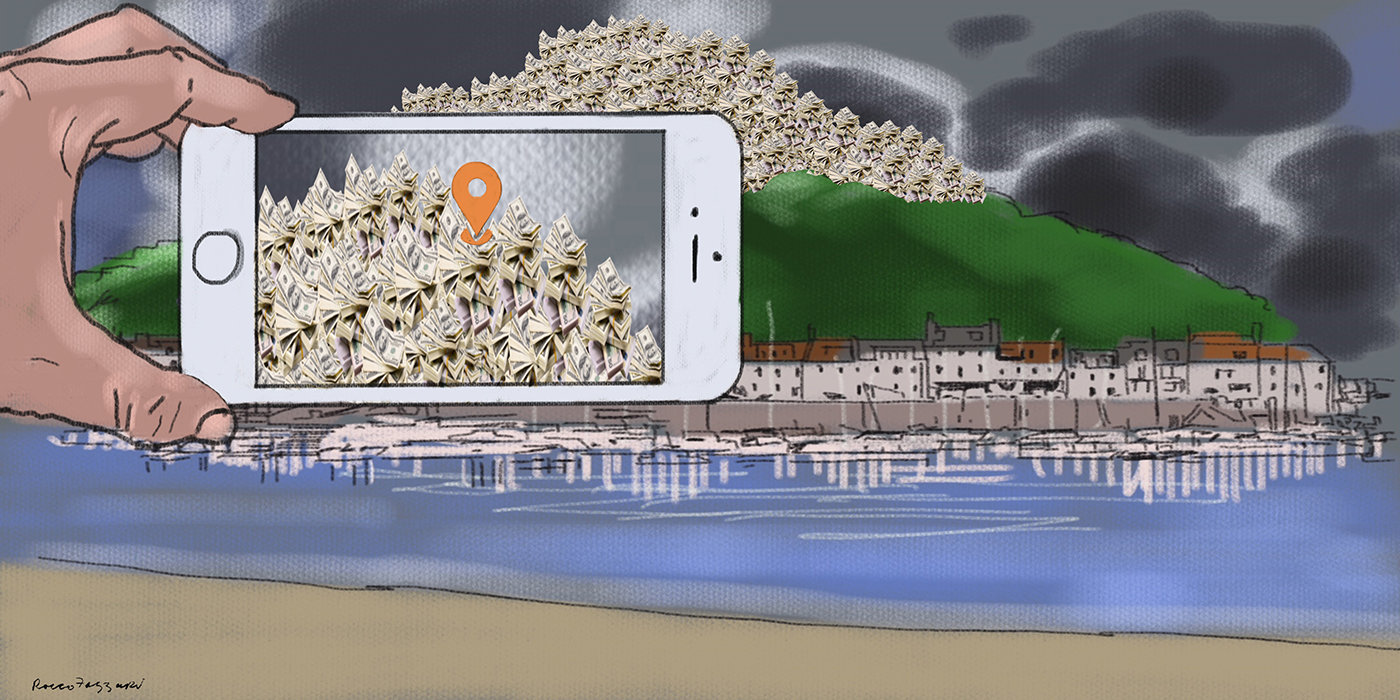

Ireland is at the center of this arrangement The Emerald Isle is a friendly place for American multinationals EU membership, an educated, Englishspeaking workforce, and a corporate tax rate of 125% have lured Amazon, Google, Facebook, Microsoft, and Apple to set up their European headquarters in Dublin and Cork G7 countries that make up lucrative markets for US tech giants have moved closer to a plan to squeeze more tax money from the coffers of Amazon, Apple, Facebook and Google The group, including Britain, Canada, France, Germany, Italy, Japan and the United States, has visions of a global tax rate of at least 15 percent on the multinational Under G7's proposed tax rules, tech giants like Facebook and Apple would still be unlikely to shift bases from Ireland, which has perks like a low 125% rate — Irish incentives such as tax treaties continue to be a draw — Tech companies have publicly supported the G7 agreement

Ireland, the European home of tech giants like Apple and Google, is looking to reach a compromise over the push by G7 countries for a common global tax rate of 15pc Ireland currently offers theTo purchase by phone, please call 1800 92 38 98 Lines are open Monday–Friday 0900–00 Find all the information you need about your Apple Online Store order To modify, track or return your order, or simply update your account info, just go to the Order status page For other enquiries, contact Apple Store Customer Service on 1800 92 38 98 Ireland has become the base of European operations for several of the largest international companies, including Google, Apple Inc and Facebook Inc The G7's minimum tax proposal aims to stop

IndiaUS to clash on Google Tax over new G7 corporate tax plan Report India is seemingly positioned to be at loggerheads with the United States of Ben Lovejoy Jun 21st 21 440 am PT @benlovejoy The 125% corporate tax paid by Apple, Google, Microsoft, and other companies to Ireland would have to end under a global tax planIreland will be mega pissed that there will be no good reason for companies like Apple, Microsoft, Facebook, Twitter, eBay, PayPal, AirBNB, Accenture, Ingersoll Rand, Seagate etc to base their Head Offices there Their low tax rate of 2% to 5% has been a good little earner for the country while doing absolutely nothing

Irish Finance Minister Stands Firm On Apple Tax Deal In Budget Speech Apple The Guardian

World S Richest Face Tax Squeeze After 40 Boost To Fortunes The Japan Times

In Europe, such a tax code change would be felt in Ireland, which has attracted companies such as Apple with the 125% corporation tax rate It remains unclear whether the G7 will achieve its goal The attraction determination reverses a Excessive Court docket ruling that under16s would wrestle to provide knowledgeable consent Finance ministers in London from the G7 group of advanced economies agreed over the weekend to impose a minimum global corporate tax of 15%, however, concerns have been raised that Amazon could be ruled out of the equationThe landmark deal aims to make some of the world's largest multinational technology companies, such as Apple (), Google and Facebook pay

Will G7 Reach A Compromise On Digital Tax Amid U S France Dispute Cgtn

Ireland Confident G7 Tax Deal Won T Dent Multinational Investment Reuters

The Metropolitan Police commissioner has accused tech giants of making it harder to identify and stop terrorists The tech giants' focus on endtoend encryption was making it "impossible in someIn what could be the biggest corporation tax reform in years, Ireland stands to lose €2bn Sat, Jun 5, G7 countries that make up lucrative markets for US tech giants have moved closer to a plan to squeeze more tax money from the coffers of Amazon, Apple, Facebook and Google The group, including

Ireland Pushes For Compromise On Minimum Global Corporate Tax Appleinsider

G 7 Countries Agree On 15 Corporate Tax

Ireland has become the base of European operations for several of the largest international companies, including Google, Apple and Facebook The G7's minimum tax proposal aims to stop companies from using lowtax jurisdictions to cut their tax bills, and countries from competing to offer everlower rates G7 countries move closer to tax plan for US tech giants G7 countries that make up lucrative markets for US tech giants have moved closer to a plan to squeeze more tax money from the coffers of Amazon, Apple, Facebook and Google The group, including Britain, Canada, France, Germany, Italy, Japan and the United States, has visions of a global , 942 PM 3 min read G7 countries that make up lucrative markets for US tech giants have moved closer to a plan to squeeze more tax money from the coffers of Amazon, Apple, Facebook and Google The group, including Britain, Canada, France, Germany, Italy, Japan and the United States, has visions of a global tax rate of at least 15 percent on the

Shailene Woodley Is Pretty In Pink At Kentucky Derby With Fiance ron Rodgers Showbiz Remarkboard

Apple Faces Higher Taxes After G7 Agree To Global Tax Rate Changes Appleinsider

SAN FRANCISCO, United States— G7 countries that make up lucrative markets for US tech giants have moved closer to a plan to squeeze more tax money from the coffers of Amazon, Apple, Facebook and Google The group, including Britain, Canada, France, Germany, Italy, Japan and the United States, has visions of a global tax rate of at least 15 percent on theFrom €1,179 before tradein 1 Learn more Buy Apple Fitness Plus The first fitness service powered by Apple Watch Try it for 1 month free 2 Learn more Try it free 2 Buy a Mac or iPad for college Get AirPods 3 Silicon Valley companies on Saturday signaled approval of a G7 deal to back a 15% minimum global corporate tax The deal has been described as 'historic'

Ireland On Brink G7 Tax Plan Threatens Major Exodus Of Tech Giants In Dublin World News Express Co Uk

Facebook Criticizes Apple As It Welcomes Europe S New Tech Rules

The G7 agreement should help to resolve trade conflicts that arise from debates about how to tax internet companies and other multinational companies that have been able to take advantage of low global tax rates in the past Notable corporate tax havens, such as Ireland, are not party to this agreementIreland's second biggest opposition party has backed a "small increase" in the country's corporate tax rate, in a sign that Dublin's longstanding political consensus on multinationals is cracking after the G7 agreed a plan for global taxation reform Ireland's 125 per cent headline tax rate has been central to its success in attracting multinational companies for many years New Tax Regime Won't Push Big Tech Companies Out of Ireland By Ivan Levingston and Siddharth Vikram Philip , 900 PM PDT Irish incentives such as tax treaties continue to be a

/cloudfront-us-east-2.images.arcpublishing.com/reuters/KHNMKPI2JZOHNG43RAD23GL6VY.jpg)

Ireland Confident G7 Tax Deal Won T Dent Multinational Investment Reuters

Hackers Steal 26m Logins For Facebook Amazon Apple Other Sites Using Virus That Takes Your Pic If Device Has A Cam

UK condemns raid on prodemocracy newspaper Apple Daily as directors arrested in Hong Kong Dominic Raab said China must respect freedom of the press amid fears of a wider crackdown on Hong Kong'sAmazon and Facebook to fall under new G7 tax rules Yellen 'Both Amazon (AMZNO) and Facebook (FBO) will fall under new proposals for a global minimum corporation tax agreed by the Group of Seven on Saturday, United States Treasury Secretary Janet Yellen said Asked whether the two companies would be covered by the proposal, Yellen said "It Analysts say the tax deal wouldn't hurt companies unless it's agreed with taxhaven countries such as Ireland, whose economy has been booming with the influx of billions of dollars in investment from multinationals due to lower taxes Shares of Facebook, Amazoncom, Apple, Microsoft and Googleparent Alphabet were all down between 04% and 07%

Developing Countries Refuse To Endorse G7 Corporation Tax Rate

New Global Tax Regime Won T Push Big Tech Companies Out Of Ireland South China Morning Post

By Suranjali Tandon, National Institute of Public Finance and Policy, New Delhi, India For developing countries like India, the agreement reached by the G7 Finance Ministers on June 5 on proposed changes to international tax rules under "pillar one" and "pillar two" may bring little in terms of new tax revenue while imposing new restrictions on tax sovereignty The G7 also said that the global minimum should apply on a countrybycountry basis – that means that it should apply to earnings in each country and multinationals would not be allowed to mix earnings from different countries for the purpose of the minimum tax If an OECD deal is agreed, Ireland will come under pressure to adopt the new Explainer G7 tax deal – what was agreed and what does it mean for Ireland?

Varadkar Says High Irish Tax Rates Are A Problem Is He Correct

Silicon Six Dodged 100 Billion In Taxes Over Past Decade Children S Health Defense

Finance ministers from the G7 group of rich countries gave the reenergised negotiating process a big fillip at their meeting on June 4th This global initiative will directly affect Ireland, due to the 125% corporation tax Ireland's multinational tax practices was a strong feature of the global initiative of 15% corporation tax However, multinational companies, in particular tech companies such as Facebook, Google and Apple, reside in Ireland largely due to the corporation tax Ireland, which hosts HQs for many tech firms, signalled it's seeking a compromise on corporate tax;

France Defiant On Plans To Impose Gafa Tax On Tech Giants

Irishcentral Com Home Facebook

IRELAND will face the brutal 'impact' of the G7's tech tax pledge, with fears some of the world's biggest multinationals may quit Dublin throwing the future of Along with Google, Twitter and Apple, Facebook has its EU headquarters in Ireland, putting it under the oversight of the Irish data protection regulator under privacy rules known as GDPR, which allow for fines of up to 4% of a company's global turnover for breaches For example in 18, Facebook, which has its international HQ in Dublin, paid £285m in tax to the UK, although its revenue was £165bn However, under the G7 deal, companies could be taxed in

Ireland The Home Of Apple And Google In Europe Is Seeking A Compromise On Biden S Plan For A 15 Global Minimum Corporate Tax Rate Reports Say

Facebook Moves Key Assets Out Of Ireland Ireland The Times

Facebook, Alphabet, and Apple still look like great companies, but they're bumping up against new challenges after long runs of incredible growth Video US and UK hail G7 minimum corporate This promises to be a significant hurdle to the principle of a global corporate tax in general, as Ireland has fought fiercely to preserve its 125% corporate tax rate Key evidence of this can be seen in Ireland's appeal against the European Court of Justice's decision to award the country €13bn in unpaid taxes from tech giant Apple G7 group is close to setting a global minimum corporate tax rate including Apple, Pfizer, Google, and Facebook, to set up bases here Under the G7 agreement, Ireland would have to ensure

Historic G7 Deal To Stop Global Corporate Tax Avoidance Welcomed By Tech Giants Google And Facebook Uk News Sky News

Facebook Amazon Google React Positively To G7 Minimum Global Tax Deal

The fact that the deal treats Northern Ireland differently from the rest of the UK is the central complaint of unionists Inexplicably, however, the DUP flatly rejected a formula that would have Major multinationals such as Apple, Facebook (NASDAQ ) and Google (NASDAQ ) employ approximately one in eight workers directly in Ireland, accounting for more than 80% of corporate tax revenues, which have surged in recent years Occupies

Global Corporate Tax Crackdown Gets Ethical Investor Boost The Japan Times

G7 Summit 21 Can Multilateralism Get Us Out Of The Crises Eias

Angela Merkel Makes A Low Key Farewell At The G7 Summit The New York Times

How Apple Got Its 2 Tax Rate In Ireland Quartz

As Us Tech Giants React With Fury What Does The G7 Deal Mean For France S Gafa Tax The Local

Deal On Minimum Global Corporate Tax Reached With Caveats

Reaction To The G7 Minimum Tax Agreement

Facebook Faces Antitrust Probe By Uk Regulator Financial Times

Global Tax Deal Backed By 130 Nations Ireland And Hungary Stay Out Euractiv Com

Facebook S Eu Uk Monopoly Probe Is The Latest Big Tech Battleground Cgtn

G7 Tax Plan Tech Giants Like Apple Facebook Google May Have To Pay Tax In India Business News

Irish Watchdog Fines Twitter In Landmark For Eu Data Privacy Regime News Medias

G7 Countries Move Closer To Tax Plan For Us Tech Giants

G7 Nations Reach Landmark Deal To Overhaul Global Corporate Tax On Tech Firms South China Morning Post

1

New Global Tax Regime Won T Push Big Tech Companies Out Of Ireland South China Morning Post

G7 Leaders Vow To End Race To Bottom On Taxes World News Wionews Com

Apple S Offshore Move Has Helped Save Them Billions In Taxes

G7 Countries Move Closer To Tax Plan For Us Tech Giants Technology Dunya News

G7 Tax Deal The Questions Hanging Over Big Tech And Ireland

Facebook V Apple The Ad Tracking Row Heats Up c News

Will Tax Crackdown Force The Likes Of Apple Amazon Google And Facebook To Pay More News The Sunday Times

The G7 Might Weaponize Taxes In Hungary Daily News Hungary

Varadkar Says High Irish Tax Rates Are A Problem Is He Correct

Facebook To Close Irish Holding Companies At Centre Of Tax Dispute Facebook The Guardian

Us Tech Giant Shares Barely React To G7 Tax Deal The Economic Times

G7 Countries Move Closer To Tax Plan For Us Tech Giants The Economic Times

Amazon Apple Google And Other Tech Giant Shares Unmoved By Proposed Tax Clampdown

Facebook Amazon Google React Positively To G7 Minimum Global Tax Deal

G7 Deal Will Likely Raise Taxes For Tech Giants Like Apple And Google Engadget

Shares In Us Tech Giants A Notch Lower After Landmark G7 Tax Deal Arab News

Ireland On Brink G7 Tax Plan Threatens Major Exodus Of Tech Giants In Dublin World News Express Co Uk

Global Agreement Could Force Tech Giants And Other Multinationals To Pay Australia Up To 5 7bn In Tax Tax The Guardian

Fate Of Ireland S Tech Boom Is About More Than Tax

G7

Malala Partners With Apple To Produce Dramas Comedies Documentaries Reuters

Global Corporate Tax Revamp Deal Set For G7 Meet Momentum Bloomberg

G7 Tax Deal Will See Apple Pay Higher Taxes In Europe 9to5mac

G7 Teaches Tech Giants A Taxing Lesson In Corporate Social Responsibility Newsroom

Emilien Hoet Author At Clim8 Invest The 1 App For Sustainable Investing

Historic G7 Deal To Stop Global Corporate Tax Avoidance Welcomed By Tech Giants Google And Facebook Uk News Sky News

Taxing Big Tech To Fund Economic Recovery Marketexpress

The World Can T Rely On A 19s Tax System Rishi Sunak Tells G7

Silicon Six Tech Giants Accused Of Inflating Tax Payments By Almost 100bn Tax Avoidance The Guardian

G7 Nations Reach Landmark Deal To Overhaul Global Corporate Tax On Tech Firms South China Morning Post

Global Regulators Net Tightens Around Big Tech Financial Times

Apple Dodges 15b Tax Bill In Eu Court Appeal Icij

3

Tax Paid By Apple Google And Others To Rise Ireland Unhappy 9to5mac

Who Will Be Affected By G7 Global Tax Deal Which Countries Have Signed It As Com

Facebook S Remote Work Move Means Floodgates Have Opened

France Says Crazy That Apple And Others Get Permanent Tax Haven Status 9to5mac

New Tax Regime Won T Push Big Tech Companies Out Of Ireland Bloomberg

G7 Tech Tax Deal Taxing Amazon Apple Is Like Squeezing Rice Pudding Bloomberg

Eu Hails G7 Tax Agreement But Internal Divisions Could Thwart Consensus Euronews

Ireland Facing Brutal Impact Of G7 Tech Tax Pledge As One In Eight Jobs Could Go World News Express Co Uk

Until The Eu Tackles Tax Avoidance Big Companies Will Keep Getting Away With It Aidan Regan The Guardian

Irish Regulator Queries Facebook On Transcription Of Users Audio Technology News Firstpost

Apple Google Amazon Other Tech Giants May Have To Pay Higher Taxes As G7 Nations Reach Landmark Deal

G 7 Tax Plan May Not End Ireland S Appetite For Apples And Other Tech Bloomberg

New Tax Regime Won T Push Big Tech Firms Out Of Ireland Ht Tech

Apple

G7 Backs Global Corporate Tax In First Step Towards Reform Economist Intelligence Unit

Global Minimum Tax Still Far From Becoming Reality European Data News Hub

Oecd Says 130 Countries Agree To 15 Percent Minimum Corporate Tax Rate

G7 Nations Strike Deal To Tax Big Companies And Squeeze Havens Bof

Global Tax Deal Reached Among G7 Nations The New York Times

Brussels Faces Test Of Its Will To Tackle Big Tech Financial Times

Apple And Facebook Trade Accusations Over Data Privacy Financial Times

G7 Tech Tax Deal Won T Do Much For Hard Pressed Retailers Opinion Retail Week

G7 Strikes Historic Agreement On Taxing Multinationals Financial Times

What Is The G7 Summit And Why Is It So Important

Facebook Stops Accepting Foreign Funded Ads About Ireland S Abortion Vote Techcrunch

G7 Countries Reach Agreement To Tax Multinational Companies World News

/cdn.vox-cdn.com/uploads/chorus_asset/file/11105269/acastro_180522_facebook_0001.jpg)

Facebook Expects Ad Tracking Problems From Regulators And Apple The Verge

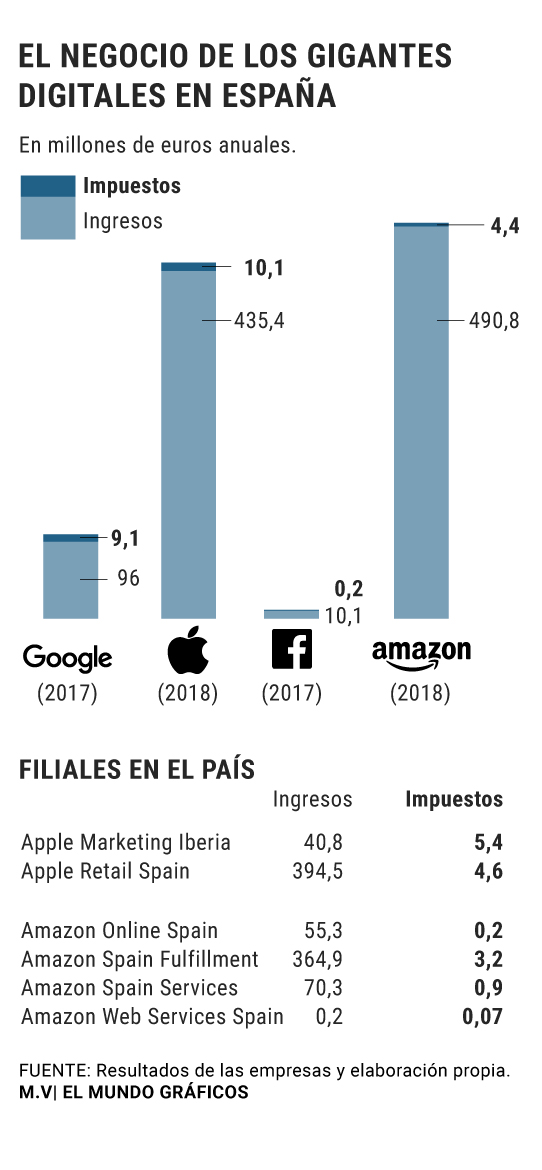

Digital Giants Tiny Taxes Google Apple Facebook And Amazon Pay 23 9 Million A Year Teller Report

Digital Brief Powered By Facebook Microtargeting Debate Protecting Gig Workers Apple Antitrust Euractiv Com

Ireland Government Set To Abandon 12 5 Tax Rate Report News Dw 14 07 21

Historic G7 Deal To Stop Global Corporate Tax Avoidance Welcomed By Tech Giants Google And Facebook Uk News Sky News

New Tax Regime Won T Push Big Tech Companies Out Of Ireland Bloomberg

/cdn.vox-cdn.com/uploads/chorus_asset/file/9809499/108122161.jpg.jpg)

Apple Agrees To Pay Ireland 15 4 Billion In Back Taxes To Appease Eu The Verge

G7 Countries Move Closer To 15 Corporation Tax Plan As Finance Minister Defends Ireland S 12 5 Rate

0 件のコメント:

コメントを投稿